Road tax refund form pdf

Road tax refund form pdf

Motor fuel tax licensees due a refund may file a claim within one year from the date of the invoice showing the amount of tax paid. The following links provide more information on the types of refunds, eligibility, procedures for claims, invoice requirements and the appropriate forms and instructions.

Form samples dvla tax refund html dvla you are eligible to receivex disc refund phishing my vehicle road v14. Vehicle tax refund form road pdf uk dvla scam email.

Texas Sales and Use Tax Forms If you do not file electronically, please use the preprinted forms we mail to our taxpayers. If your address has changed, please update your account .

8/06/2015 · Hello, I stumbled upon this thread while searching for the possibilities of road tax refunds for the second owner and appreciate the clarification provided by h.selvakumar.

To get a refund for each full calendar month left on the tax disc, you must post this filled-in form to us before the first day of the month you want the refund from.

Tax Return Name: PDF: Fillable PDF: 1: Return for Annual Income Tax (23/03/2018) Annex 1: List of Related-Party Transactions Annex 2: For Local Branch

Indirect Tax Refund Recovery Services Has your company… •Conducted an indirect tax review or been audited by a tax authority in the last three

To apply for a refund of motor tax, you need to download and complete form RF120 (pdf). Your completed application form should include the current tax disc and the Vehicle Licensing/Registration Certificate or Registration Book. If you are claiming a refund on the basis of an illness or injury, you should include a medical certificate from your doctor or health professional. If you are

Section 6 – Tax or Refund Calculation Report Tax Amounts – Do not Report Gallons or Consideration The signatory affirms that the information contained on this return and

View, download and print Omc-11a – Connecticut Motor Carrier Road Tax Return pdf template or form online. 1380 Ct Tax Forms And Templates are collected for any of your needs.

Renewal Reminder Road Tax Refund Form Pdf Application Post Office Dvla Return Uk Samples. View. Form Samples Tax2011ny Dtf803 20120312 Page 1 Vehicle Tax Application Road Refund Pdf Registration Post Office Nys . View. Sales And Use Tax Regulations Article Vehicle Registration Form Road Application Ireland Uk Refund Pdf Post Office. View. Form Samples Road Tax Exemption …

Where the plates are lost, stolen or destroyed the vehicle owner will need to complete a ‘Lost – stolen number plates (Form VL14)’ before a refund can be considered. Cancelled deal: Only applies when a vehicle is not delivered to a client by a vehicle dealer.

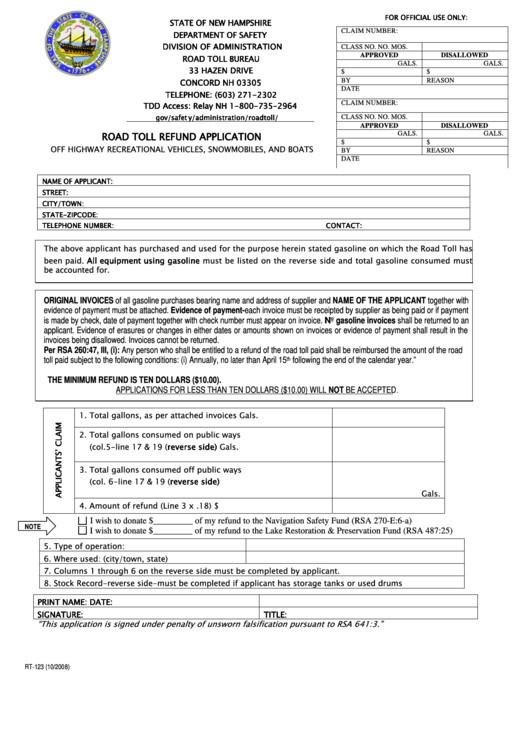

Per Saf-C 310.01 Refunds – General. (e) Any evidence of erasures or other changes in the name of purchaser, supplier, type of fuel, date or the amounts shown on the invoices shall cause the portion of the requested refund which is dependent upon the documentation to be denied.

Fuel Tax Refund Application, must be on file with the Department in order to process this claim. Form 4924 can be submitted at the same time Form 4924 can be submitted at the same time as Form 4923.

Instructions for Iowa Fuel Tax Refund Claim Who Can Use This Form? This form is used to file refund claims for: • transport diversions, claim type 81

About six hundred Pennsylvania tax forms are offered by Formsbirds on this page. More than twenty types of tax forms are selected for your personal use and various needs.

Vehicle Tax Refunds National Numbers

Motor tax Citizens Information

E-file your Form 2290 with ExpressTruckTax using IRS Form 2290 instructions 2018. Find here the 2290 PDF documents for the tax year 2018-2019 & prior tax years. Find here the 2290 PDF documents for the tax year 2018-2019 & prior tax years.

RF120 Form – Application for Refund of Motor Tax pdf, 66kb.Take a look at how to apply for a refund of motor tax. reader 9 pdf >VTL308 – Application for a refund of tax on surrender of a trade.

If you still cannot download the form, using your mouse, right-click on the link for the form needed. Select “Save Target As” (if you are using a Netscape browser select “Save Link As” or “Save Link Target As” depending on the version you have). Save the form and then open it from that location.

View, download and print Omc-11a – Connecticut Motor Carrier Road Tax Return (back) pdf template or form online. 1380 Ct Tax Forms And Templates are collected for any of your needs.

Motor Fuels Tax Forms The following forms can be viewed in Adobe Acrobat PDF format. PDF formatted documents contain the same text as the original printed documents.

17-209(c)(v)(C): A copy of the most recent sales or use tax report or proof that the person is exempt sales or use taxes shall accompany the claim for refund. All fuel is subject to the $.01 Additional License Tax.

If you want to make an application for a refund of your road tax, please go through the following steps. Step 1. Print the Application for a refund of motor tax (pdf 68.1 Kb) Step 2. Ensure that you have the following documents: Your tax Disc. Vehicle registration documents. Any other documents that will be required to support your claim. Step 3. Send your completed application form along with

application form for refund You may take about 5 minutes to complete this form and you may need the following information to fill in the form: • The vehicle registration number

on the income tax return by using form IA 4136. A refund of less than A refund of less than will be allowed if the claimant is not required to file an income tax return

3That the motor vehicle is subject to a lower rate tax on the ground mentioned in sub-section (3) of section 9. 5. 3 That I have erroneously paid more tax than what was leviable .

Form 16 (Rule 20) Application for Refund of Tax I,.. residing at

Instructions. Use this application to obtain a fuel tax refund permit account. You must have a permit account to claim a refund of state fuel tax paid for fuel used off-road or in a tax-exempt manner.

Driving and road transport; Form Refund of vehicle tax or return of a nil value tax disc Form and guidance on how to fill in form V14 – application for a refund of vehicle tax. Published 1 July

who purchases undyed, tax-paid diesel fuel for on-road purposes OTHER THAN TO PROPEL VEHICLES, may file a claim for refund. However, a person filing such a claim must pay use tax under Section (s.) 212.0501, F.S., on the average net cost per gallon.

Attached is Form SUBT:DR, Claim for Motor Fuel Tax Refund, which has been amended to include the computation of the state sales tax. The amended form includes a block where the petitioner computes the amount of sales tax due and nets that amount against the amount of motor fuel excise tax to be refunded. The department will issue a refund of the net amount due. Failure to compute the sales tax

On June 05, 2014 at 8:30, The General Department of Taxation organized a Seminar on Tax Administration Reform in Malaysia under the presidency of H.E.Kong Vibol, Delegate of the Royal Government in charge as Director General of the General Department of Taxation…

Fill out the RUCOR application form [PDF, 112 KB]. You can complete the form online and save it for emailing or printing. Ensure all fields of the application form are completed including your email address and bank account details for the refund.

RUC OFF-ROAD REFUND CLAIMS GPS Log Book – Home

The car tax refund will be automatically triggered when either: you notify DVLA of the sale using the yellow section 9 of your registration certificate (V5C/3); or …

of the tax office may file a blue return with various privileges. The goal of this system is to popularize the self-assessment system and to promote proper bookkeeping of accounts and records.

Form 06-106 (Back)(Rev.9-16/22) Instructions for Completing Texas Claim for Refund of Gasoline or Diesel Fuel Taxes. NOTE: If you are filing a claim for both gasoline and diesel fuel tax refund for the same period, you may file both claims on one form.

a pro-rata rate of the motor vehicle tax or road use charge from the date the number plates are surrendered to the expiry of the NSW registration. The registration fee is not refundable. Vehicles registered interstate into the same name will incur a cancellation fee. b. Vehicles registered interstate into a new name will incur a transfer and cancellation fee. c. Roads and Maritime does not

Application for Refund of Ontario c. R.31, Subsections 32(4) and 32(4.1)). Personal Information is collected on this form under authority of the . Retail Sales Tax Act, R.S.O. 1990, c. R.31, Subsections 4.2(8) (as amended) and may be used to determine eligibility for a refund of retail sales tax. Questions about this collection should be directed to: Ministry of Finance, 33 King Street

The e-payment of income tax facility was launched by the IT department of India for taxpayer with an online banking account. Learn how to make e-payment of income tax in India at Coverfox.

Title: Application for Refund of Motor Tax – RF120 Author: Limerick Cty Council Subject: Application for Refund of Motor Tax – RF120 Keywords: refund;motor tax;tax;RF120 – road construction equipment list pdf Application for Refund – OFF-ROAD VEHICLES Claims must be filed with our office within two years of the purchase or lease commencement date. An off-road vehicle is a snowmobile, all-terrain vehicle, dirt bike, mini-bike or trail-bike.

Use this form to apply for a refund of the Virginia Fuels Tax for . eligible uses. Instructions: Follow the instructions on page 2 of this form. Mail the completed application to DMV at the address above. Incomplete applications may not be processed. APPLICANT INFORMATION . FUELS TAX REFUND APPLICATION . Go Green! Apply for a refund online at www.dmvNow.com, Fuels Tax Refund …

Motor Carrier Road Tax/IFTA Forms. IFTA-100 — IFTA Quarterly Fuel Tax Report. IFTA-101 — IFTA Quarterly Fuel Tax Schedule. IFTA-101i — Instructions for Completing IFTA Quarterly Fuel Tax Schedule

(f) Motor fuel claimed on the refund application shall be the actual amount of motor fuel used by the applicant. Application for a refund shall be submitted: (1) Annually but no later than April 15 following the end of the calendar year.

TS 217 (07/25/2014) Purpose: Use this form to apply for a fuels tax refund on fuel used in boats or watercraft. Instructions: Follow the instructions on the reverse side of this form.

5/11/2018 · Information about Form 2290, Heavy Highway Vehicle Use Tax Return, including recent updates, related forms and instructions on how to file. Form 2290 is used to figure and pay the tax due on highway motor vehicles that falls within one of the categories shown in the tax computation schedules on the form.

Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as the questions on the Tax return …

Purpose of Form: Complete Form 2290-V if you are making a payment by check or money order with Form 2290, Heavy Highway Vehicle Use Tax Return. We will use Form 2290-V to credit your payment more promptly and accurately, and to improve our service to you. If you have your return prepared by a third party and a payment is required, provide Form 2290-V to the return preparer. …

You can claim a refund of vehicle tax if you’re taking your vehicle off the road, selling it or if it’s been scrapped, exported or stolen. You can get a refund for each full month still to run on the tax disc.

The particulars specified will be stored and/or form part of the Excise Duty Refund Register maintained by the Transport Agency and may be used to amend information on …

Fuel tax refunds for marine use You could receive a refund of Washington State fuel tax for non-dyed fuel used in marine vessels for business or pleasure.

Prior years individuals tax return forms & schedules Attribution managed investment trust (AMIT) tax return instructions 2018 Business and professional items 2018

If your car has been stolen and you pay tax by direct debit, you should get an automatic refund. Otherwise you will have to contact the DVLA to get a form …

Indirect Tax Refund Recovery Services Deloitte US

circulation tax, road tax) and taxes on motoring (fuel tax). Traditionally, the ACEA Tax Guide covers the member states of the European Union as well as other European countries such as Switzerland, Iceland, Norway and Turkey.

RUC OFF-ROAD REFUND CLAIMS These detailed instructions direct RUC refund seekers on using the NEW Tracking Zone function to calculate off-road mileage, by setting tracking zones, capturing odometer readings and then downloading a Tracking Zone Report to facilitate completing the RUCOR claim form. Once logged in and viewing the Trips page, click on the zone name that you wish to track off-road

application for a refund of motor tax rf120 Tax Disc must be surrendered immediately as refunds are generally calculated from the first of the month following the surrender of the disc. A minimum of 3 unexpired whole calendar months must be left on the disc when surrendered.

Pennsylvania Tax Form 592 Free Templates in PDF Word

Fuel tax refunds for marine use

Fuel Tax Refund Permit Application Department of Licensing

Application for Refund of Motor Tax RF120 – Dublin

Download General Department of Taxation Cambodia

Request for Refund of NSW Registration

FR01 APPLICATION FORM FOR REFUND ONE.MOTORING

– RUC refunds NZ Transport Agency

Apply for a vehicle licence refund DOT Home

ACEA 2016 Tax Guide

Motor Carrier Road Tax/IFTA Forms

Pennsylvania Tax Form 592 Free Templates in PDF Word

Tax return Australian Taxation Office

Motor fuel tax licensees due a refund may file a claim within one year from the date of the invoice showing the amount of tax paid. The following links provide more information on the types of refunds, eligibility, procedures for claims, invoice requirements and the appropriate forms and instructions.

Where the plates are lost, stolen or destroyed the vehicle owner will need to complete a ‘Lost – stolen number plates (Form VL14)’ before a refund can be considered. Cancelled deal: Only applies when a vehicle is not delivered to a client by a vehicle dealer.

Form 06-106 (Back)(Rev.9-16/22) Instructions for Completing Texas Claim for Refund of Gasoline or Diesel Fuel Taxes. NOTE: If you are filing a claim for both gasoline and diesel fuel tax refund for the same period, you may file both claims on one form.

5/11/2018 · Information about Form 2290, Heavy Highway Vehicle Use Tax Return, including recent updates, related forms and instructions on how to file. Form 2290 is used to figure and pay the tax due on highway motor vehicles that falls within one of the categories shown in the tax computation schedules on the form.

8/06/2015 · Hello, I stumbled upon this thread while searching for the possibilities of road tax refunds for the second owner and appreciate the clarification provided by h.selvakumar.

Section 6 – Tax or Refund Calculation Report Tax Amounts – Do not Report Gallons or Consideration The signatory affirms that the information contained on this return and

Application for Refund of Ontario c. R.31, Subsections 32(4) and 32(4.1)). Personal Information is collected on this form under authority of the . Retail Sales Tax Act, R.S.O. 1990, c. R.31, Subsections 4.2(8) (as amended) and may be used to determine eligibility for a refund of retail sales tax. Questions about this collection should be directed to: Ministry of Finance, 33 King Street

Instructions. Use this application to obtain a fuel tax refund permit account. You must have a permit account to claim a refund of state fuel tax paid for fuel used off-road or in a tax-exempt manner.

View, download and print Omc-11a – Connecticut Motor Carrier Road Tax Return (back) pdf template or form online. 1380 Ct Tax Forms And Templates are collected for any of your needs.

Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as the questions on the Tax return …

Fill out the RUCOR application form [PDF, 112 KB]. You can complete the form online and save it for emailing or printing. Ensure all fields of the application form are completed including your email address and bank account details for the refund.

If you still cannot download the form, using your mouse, right-click on the link for the form needed. Select “Save Target As” (if you are using a Netscape browser select “Save Link As” or “Save Link Target As” depending on the version you have). Save the form and then open it from that location.

To get a refund for each full calendar month left on the tax disc, you must post this filled-in form to us before the first day of the month you want the refund from.

RUC OFF-ROAD REFUND CLAIMS These detailed instructions direct RUC refund seekers on using the NEW Tracking Zone function to calculate off-road mileage, by setting tracking zones, capturing odometer readings and then downloading a Tracking Zone Report to facilitate completing the RUCOR claim form. Once logged in and viewing the Trips page, click on the zone name that you wish to track off-road

If your car has been stolen and you pay tax by direct debit, you should get an automatic refund. Otherwise you will have to contact the DVLA to get a form …

Motor Carrier Road Tax/IFTA Forms

Fuel tax refunds for marine use

Motor Carrier Road Tax/IFTA Forms. IFTA-100 — IFTA Quarterly Fuel Tax Report. IFTA-101 — IFTA Quarterly Fuel Tax Schedule. IFTA-101i — Instructions for Completing IFTA Quarterly Fuel Tax Schedule

Application for Refund of Ontario c. R.31, Subsections 32(4) and 32(4.1)). Personal Information is collected on this form under authority of the . Retail Sales Tax Act, R.S.O. 1990, c. R.31, Subsections 4.2(8) (as amended) and may be used to determine eligibility for a refund of retail sales tax. Questions about this collection should be directed to: Ministry of Finance, 33 King Street

of the tax office may file a blue return with various privileges. The goal of this system is to popularize the self-assessment system and to promote proper bookkeeping of accounts and records.

RF120 Form – Application for Refund of Motor Tax pdf, 66kb.Take a look at how to apply for a refund of motor tax. reader 9 pdf >VTL308 – Application for a refund of tax on surrender of a trade.

Fuel Tax Refund Application, must be on file with the Department in order to process this claim. Form 4924 can be submitted at the same time Form 4924 can be submitted at the same time as Form 4923.

If you still cannot download the form, using your mouse, right-click on the link for the form needed. Select “Save Target As” (if you are using a Netscape browser select “Save Link As” or “Save Link Target As” depending on the version you have). Save the form and then open it from that location.

TS 217 (07/25/2014) Purpose: Use this form to apply for a fuels tax refund on fuel used in boats or watercraft. Instructions: Follow the instructions on the reverse side of this form.

RUC OFF-ROAD REFUND CLAIMS These detailed instructions direct RUC refund seekers on using the NEW Tracking Zone function to calculate off-road mileage, by setting tracking zones, capturing odometer readings and then downloading a Tracking Zone Report to facilitate completing the RUCOR claim form. Once logged in and viewing the Trips page, click on the zone name that you wish to track off-road

circulation tax, road tax) and taxes on motoring (fuel tax). Traditionally, the ACEA Tax Guide covers the member states of the European Union as well as other European countries such as Switzerland, Iceland, Norway and Turkey.

Instructions. Use this application to obtain a fuel tax refund permit account. You must have a permit account to claim a refund of state fuel tax paid for fuel used off-road or in a tax-exempt manner.

Form 2290 Heavy Highway Vehicle Use Tax Return

Motor tax Citizens Information

To apply for a refund of motor tax, you need to download and complete form RF120 (pdf). Your completed application form should include the current tax disc and the Vehicle Licensing/Registration Certificate or Registration Book. If you are claiming a refund on the basis of an illness or injury, you should include a medical certificate from your doctor or health professional. If you are

Driving and road transport; Form Refund of vehicle tax or return of a nil value tax disc Form and guidance on how to fill in form V14 – application for a refund of vehicle tax. Published 1 July

Renewal Reminder Road Tax Refund Form Pdf Application Post Office Dvla Return Uk Samples. View. Form Samples Tax2011ny Dtf803 20120312 Page 1 Vehicle Tax Application Road Refund Pdf Registration Post Office Nys . View. Sales And Use Tax Regulations Article Vehicle Registration Form Road Application Ireland Uk Refund Pdf Post Office. View. Form Samples Road Tax Exemption …

View, download and print Omc-11a – Connecticut Motor Carrier Road Tax Return pdf template or form online. 1380 Ct Tax Forms And Templates are collected for any of your needs.

Texas Sales and Use Tax Forms If you do not file electronically, please use the preprinted forms we mail to our taxpayers. If your address has changed, please update your account .

Fuel Tax Refund Application, must be on file with the Department in order to process this claim. Form 4924 can be submitted at the same time Form 4924 can be submitted at the same time as Form 4923.

Fuel tax refunds for marine use You could receive a refund of Washington State fuel tax for non-dyed fuel used in marine vessels for business or pleasure.

Motor fuel tax licensees due a refund may file a claim within one year from the date of the invoice showing the amount of tax paid. The following links provide more information on the types of refunds, eligibility, procedures for claims, invoice requirements and the appropriate forms and instructions.

who purchases undyed, tax-paid diesel fuel for on-road purposes OTHER THAN TO PROPEL VEHICLES, may file a claim for refund. However, a person filing such a claim must pay use tax under Section (s.) 212.0501, F.S., on the average net cost per gallon.

3That the motor vehicle is subject to a lower rate tax on the ground mentioned in sub-section (3) of section 9. 5. 3 That I have erroneously paid more tax than what was leviable .

Application for Refund of Ontario c. R.31, Subsections 32(4) and 32(4.1)). Personal Information is collected on this form under authority of the . Retail Sales Tax Act, R.S.O. 1990, c. R.31, Subsections 4.2(8) (as amended) and may be used to determine eligibility for a refund of retail sales tax. Questions about this collection should be directed to: Ministry of Finance, 33 King Street

View, download and print Omc-11a – Connecticut Motor Carrier Road Tax Return (back) pdf template or form online. 1380 Ct Tax Forms And Templates are collected for any of your needs.

Motor Fuel Tax Refunds taxes.marylandtaxes.gov

FUELS TAX REFUND APPLICATION FUEL USED IN BOATS OR

Form 06-106 (Back)(Rev.9-16/22) Instructions for Completing Texas Claim for Refund of Gasoline or Diesel Fuel Taxes. NOTE: If you are filing a claim for both gasoline and diesel fuel tax refund for the same period, you may file both claims on one form.

The particulars specified will be stored and/or form part of the Excise Duty Refund Register maintained by the Transport Agency and may be used to amend information on …

Title: Application for Refund of Motor Tax – RF120 Author: Limerick Cty Council Subject: Application for Refund of Motor Tax – RF120 Keywords: refund;motor tax;tax;RF120

Motor Carrier Road Tax/IFTA Forms. IFTA-100 — IFTA Quarterly Fuel Tax Report. IFTA-101 — IFTA Quarterly Fuel Tax Schedule. IFTA-101i — Instructions for Completing IFTA Quarterly Fuel Tax Schedule

5/11/2018 · Information about Form 2290, Heavy Highway Vehicle Use Tax Return, including recent updates, related forms and instructions on how to file. Form 2290 is used to figure and pay the tax due on highway motor vehicles that falls within one of the categories shown in the tax computation schedules on the form.

Driving and road transport; Form Refund of vehicle tax or return of a nil value tax disc Form and guidance on how to fill in form V14 – application for a refund of vehicle tax. Published 1 July

Instructions for Iowa Fuel Tax Refund Claim Who Can Use This Form? This form is used to file refund claims for: • transport diversions, claim type 81

RF120 Form – Application for Refund of Motor Tax pdf, 66kb.Take a look at how to apply for a refund of motor tax. reader 9 pdf >VTL308 – Application for a refund of tax on surrender of a trade.

Tax Return Name: PDF: Fillable PDF: 1: Return for Annual Income Tax (23/03/2018) Annex 1: List of Related-Party Transactions Annex 2: For Local Branch

of the tax office may file a blue return with various privileges. The goal of this system is to popularize the self-assessment system and to promote proper bookkeeping of accounts and records.

Form samples dvla tax refund html dvla you are eligible to receivex disc refund phishing my vehicle road v14. Vehicle tax refund form road pdf uk dvla scam email.

On June 05, 2014 at 8:30, The General Department of Taxation organized a Seminar on Tax Administration Reform in Malaysia under the presidency of H.E.Kong Vibol, Delegate of the Royal Government in charge as Director General of the General Department of Taxation…

on the income tax return by using form IA 4136. A refund of less than A refund of less than will be allowed if the claimant is not required to file an income tax return

Fill out the RUCOR application form [PDF, 112 KB]. You can complete the form online and save it for emailing or printing. Ensure all fields of the application form are completed including your email address and bank account details for the refund.

17-209(c)(v)(C): A copy of the most recent sales or use tax report or proof that the person is exempt sales or use taxes shall accompany the claim for refund. All fuel is subject to the $.01 Additional License Tax.

Motor tax Citizens Information

FORM Tax Refund mahatranscom.in

Indirect Tax Refund Recovery Services Has your company… •Conducted an indirect tax review or been audited by a tax authority in the last three

View, download and print Omc-11a – Connecticut Motor Carrier Road Tax Return (back) pdf template or form online. 1380 Ct Tax Forms And Templates are collected for any of your needs.

Motor fuel tax licensees due a refund may file a claim within one year from the date of the invoice showing the amount of tax paid. The following links provide more information on the types of refunds, eligibility, procedures for claims, invoice requirements and the appropriate forms and instructions.

on the income tax return by using form IA 4136. A refund of less than A refund of less than will be allowed if the claimant is not required to file an income tax return

To apply for a refund of motor tax, you need to download and complete form RF120 (pdf). Your completed application form should include the current tax disc and the Vehicle Licensing/Registration Certificate or Registration Book. If you are claiming a refund on the basis of an illness or injury, you should include a medical certificate from your doctor or health professional. If you are

Form 06-106 (Back)(Rev.9-16/22) Instructions for Completing Texas Claim for Refund of Gasoline or Diesel Fuel Taxes. NOTE: If you are filing a claim for both gasoline and diesel fuel tax refund for the same period, you may file both claims on one form.

Instructions for Iowa Fuel Tax Refund Claim Who Can Use This Form? This form is used to file refund claims for: • transport diversions, claim type 81

(f) Motor fuel claimed on the refund application shall be the actual amount of motor fuel used by the applicant. Application for a refund shall be submitted: (1) Annually but no later than April 15 following the end of the calendar year.

If you want to make an application for a refund of your road tax, please go through the following steps. Step 1. Print the Application for a refund of motor tax (pdf 68.1 Kb) Step 2. Ensure that you have the following documents: Your tax Disc. Vehicle registration documents. Any other documents that will be required to support your claim. Step 3. Send your completed application form along with

Per Saf-C 310.01 Refunds – General. (e) Any evidence of erasures or other changes in the name of purchaser, supplier, type of fuel, date or the amounts shown on the invoices shall cause the portion of the requested refund which is dependent upon the documentation to be denied.

Driving and road transport; Form Refund of vehicle tax or return of a nil value tax disc Form and guidance on how to fill in form V14 – application for a refund of vehicle tax. Published 1 July

TS 217 (07/25/2014) Purpose: Use this form to apply for a fuels tax refund on fuel used in boats or watercraft. Instructions: Follow the instructions on the reverse side of this form.

who purchases undyed, tax-paid diesel fuel for on-road purposes OTHER THAN TO PROPEL VEHICLES, may file a claim for refund. However, a person filing such a claim must pay use tax under Section (s.) 212.0501, F.S., on the average net cost per gallon.

The particulars specified will be stored and/or form part of the Excise Duty Refund Register maintained by the Transport Agency and may be used to amend information on …

Attached is Form SUBT:DR, Claim for Motor Fuel Tax Refund, which has been amended to include the computation of the state sales tax. The amended form includes a block where the petitioner computes the amount of sales tax due and nets that amount against the amount of motor fuel excise tax to be refunded. The department will issue a refund of the net amount due. Failure to compute the sales tax

RUC OFF-ROAD REFUND CLAIMS These detailed instructions direct RUC refund seekers on using the NEW Tracking Zone function to calculate off-road mileage, by setting tracking zones, capturing odometer readings and then downloading a Tracking Zone Report to facilitate completing the RUCOR claim form. Once logged in and viewing the Trips page, click on the zone name that you wish to track off-road

Iowa Fuel Tax Refund Claim

Form 06-106 (Back)(Rev.9-16/22) Instructions for Completing Texas Claim for Refund of Gasoline or Diesel Fuel Taxes. NOTE: If you are filing a claim for both gasoline and diesel fuel tax refund for the same period, you may file both claims on one form.

Iowa Fuel Tax Refund Claim

Form Omc-11a Connecticut Motor Carrier Road Tax Return

Office use only Application for refund of fuel excise duty